🛟 BetterFi’s Impact

Yesterday on Labor Day, we took a moment to look back and review what BetterFi has achieved over the past few years. What has our impact been? Whom have we served?

A Little About Our Impact

More than $2 million saved.

The biggest measure of our impact that BetterFi tracks is the savings for our clients, i.e., what they would have paid for a predatory loan of the same term.

We compare the credit we extend to a flex loan of the same term (number of months) – even though there are much more expensive forms of credit than flex loans.

As of the end of July this year, BetterFi has disbursed more than $850,000 in credit.

The majority of our new clients are individuals who have some form of predatory loan (payday, title, flex, or other online loan) on which they are paying. Typical clients are paying $558 per month when they apply to BetterFi, facing predatory APRs – Annual Percentage Rates that include all interest and fees – over 250%. We have refinanced some predatory loans with APRs over 700%.

On a typical predatory flex loan of $2,400, a monthly payment of $558 would be a dollar short of covering the interest and fees.

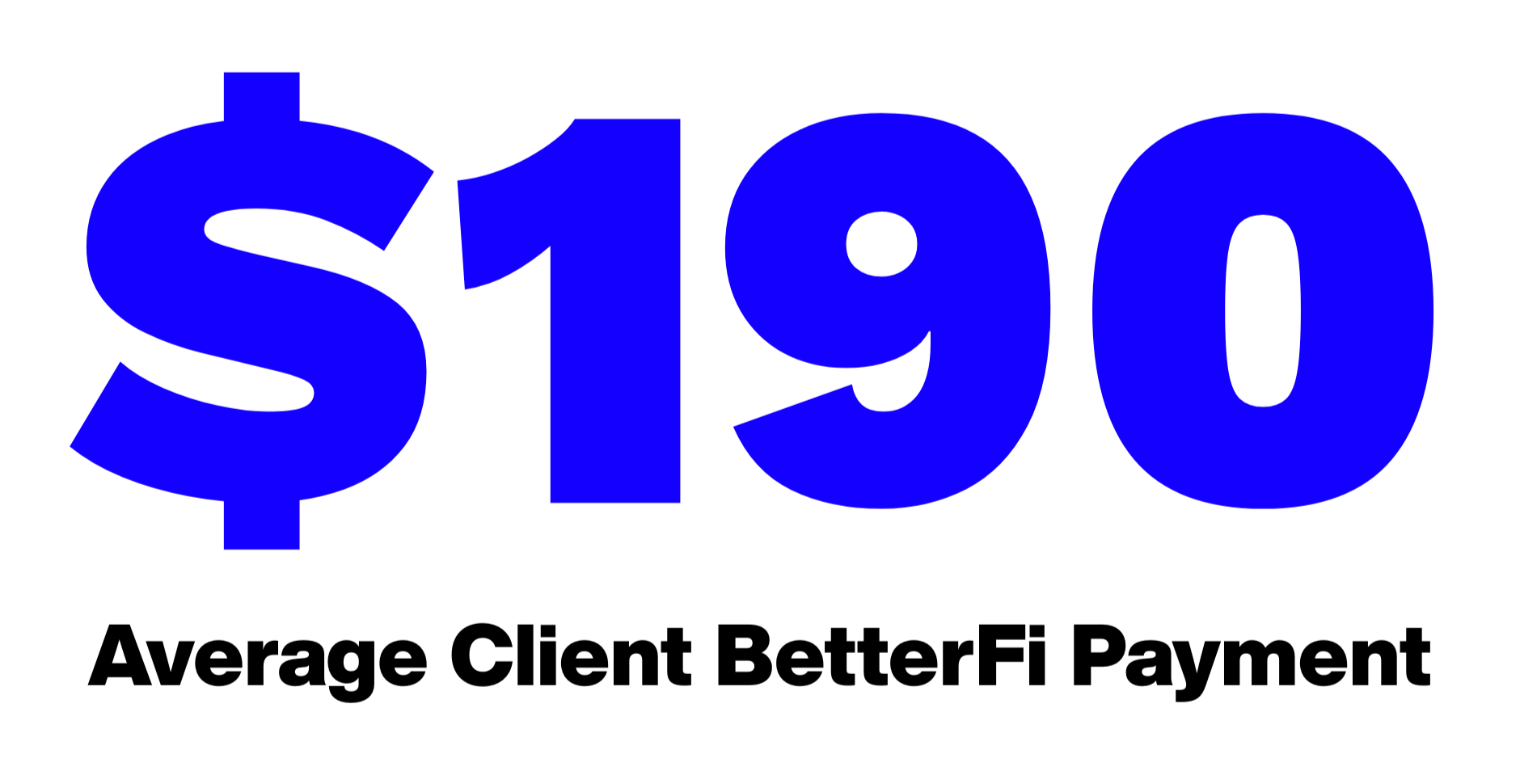

BetterFi’s typical credit client pays around $190 per month to BetterFi, with an APR that is less than a tenth of a typical flex lender’s rate. This works out to typical client savings of more than $4,000 per year.

Not only are BetterFi clients paying far more before they find BetterFi, but usually their payments to the predatory lender are not sufficient to ever pay off the predatory loan.

If someone borrows $2,000 from a predatory flex lender, what are the odds they can cover the $465 in interest and fees every month indefinitely?

BetterFi calculates savings based on the term of the credit from BetterFi, but the calculation is extremely conservative given that most clients would otherwise be stuck in a predatory loan indefinitely.

A Little About Our Clients

From Grundy County and Hamilton County

Who are BetterFi’s clients?

Most of our clients live in or around Grundy and Hamilton Counties, though we have begun extending credit across the state of Tennessee.

Especially since opening our Chattanooga office in April of this year, BetterFi has seen significant growth in clients from Hamilton.

BetterFi has disbursed more by the end of July this year than we have in any full year prior, but we have a long way still to go.

Other counties where BetterFi has extended more than $20,000 include Franklin, Marion, Warren, Coffee, Shelby, Bradley, and Rutherford counties.

The disproportionate impact of expensive predatory loans and the financial precarity of BetterFi’s clients primarily come down to income level, with around 91% of BetterFi’s clients falling into the income categories of low income, very low income, or extremely low income.

The vast majority of BetterFi’s clients’ primary income source is employment, though many have “side hustles” or use gig economy jobs to supplement their income.

BetterFi’s average client has about $2,167 in monthly income. If you’re keeping track, that means that the annual savings by BetterFi clients is equivalent to getting back about two months of pay.

Besides income level, a lack of credit history or poor credit history prevents BetterFi clients and predatory loan victims from accessing other more affordable financial products and services in the first place.

BetterFi’s clients typically have a credit score of around 569 when they apply, 146 points lower than the average score in the United States and 137 points lower than the typical Tennesseean. A fair number of BetterFi clients have no credit history prior to working with BetterFi.

We are now working to begin monitoring and evaluating scores after repayment to BetterFi to evaluate our impact in reporting to all three credit bureaus, and hope to have initial data to share by the end of the year.

Most predatory lenders do not report to any credit bureau – unless a loan goes to collections.

Looking into BetterFi clients’ other large expenses gives further insight into how a predatory loan payment can create an impossible-to-escape trap.

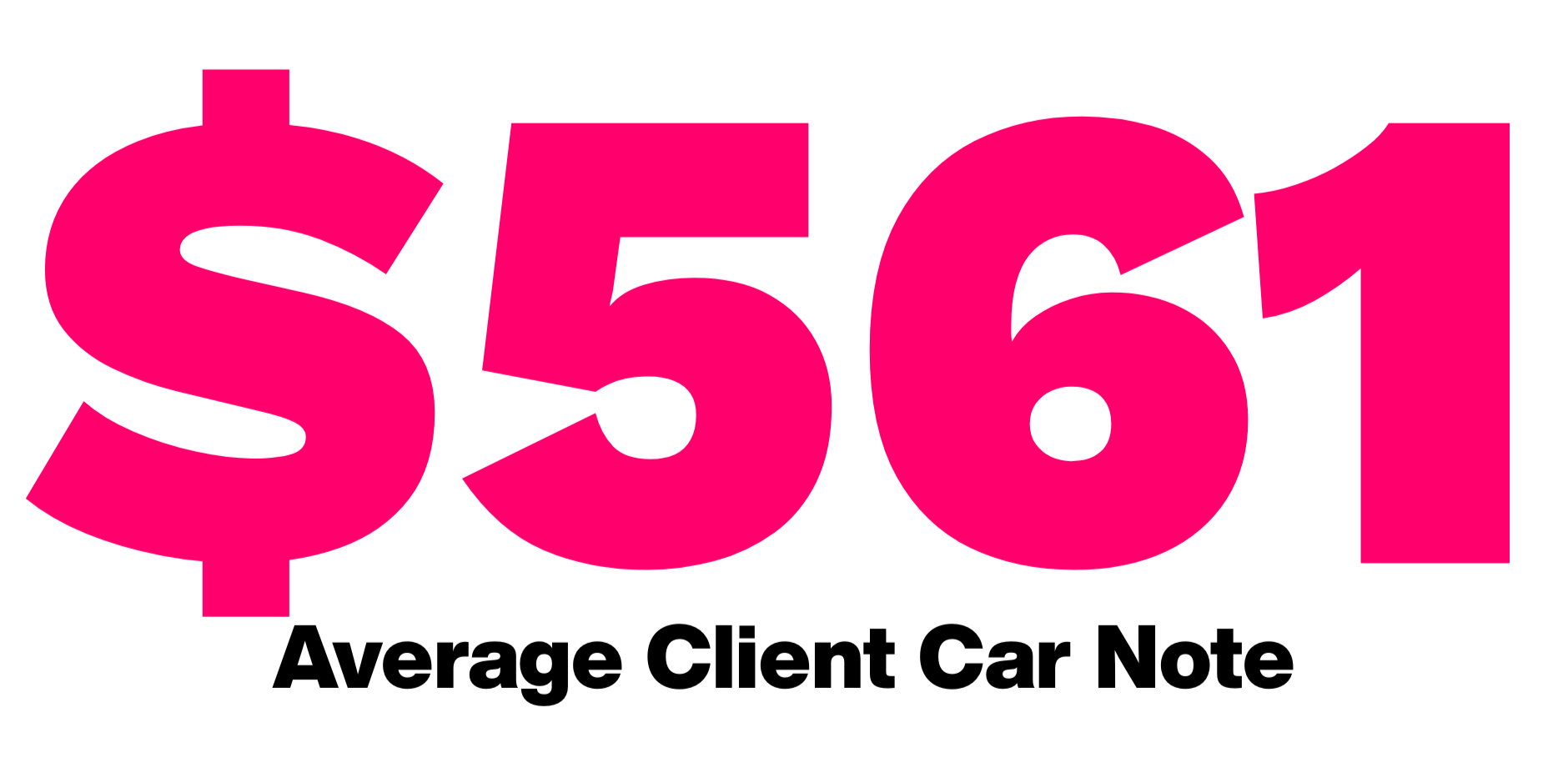

Subtracting just typical monthly expenditures for clients with housing ($648), car note ($561), and credit card ($167) expenses from our average client monthly income ($2,167) makes the problem clear.

Even ignoring all other essential expenses, how would someone with $791 free per month ever escape a predatory loan with a monthly payment of $558?

Most BetterFi clients rent – many share the cost of renting with other family members or roommates.

The last bits of data we want to share is about our clients’ demographics and how they find us.

Even with the expansion of our Chattanooga branch, the majority of BetterFi’s disbursals historically have gone to people living in rural counties, many of which are banking deserts with far more predatory lenders than banks or credit unions.

Additionally, bankruptcy can be a major hurdle for individuals to overcome in accessing credit and creating new positive credit history – 22% of BetterFi’s clients declared bankruptcy some time before applying with BetterFi.

The vast majority of our clients have come from referrals: from nonprofits, banks, churches, employers, and existing clients. Just earlier this year we began advertising substantially: the 13% of clients who found BetterFi from an advertisement have almost all come in the last 4 months.

If you work with or represent an organization that might be a potential partner, we would love to hear from you.

Our clients are a bit more likely to be women than men, and, at this point, nearly all are either White or Black. Just about 1.5% of our clients identify as Hispanic.

So who do we serve? Tennesseans trapped paying on predatory loans, looking to build financial fitness, seeking to build their credit.

Lastly …

All of this information only represents the impact of our credit program.

None of these numbers include the hundreds of people whose taxes we have filed for free through our IRS-Certified Volunteer Income Tax Assistance program, the hundreds of Grundy County eighth graders who have gone through Junior Achievement’s Economics for Success with BetterFi, or the hundreds of individuals who have gone through financial coaching, budget building, or credit workshops with us in partnership with reentry, recovery, work readiness, English-as-a-second-language, or jail programs.

Everything we are able to do is made possible by supporters who care about creating financially stable communities and supporters who care that viable paths out from dependence on predatory loans exist.

With your help, we can continue to create a Better financial future for all.

About BetterFi

BetterFi is a 501(c)3 economic justice enterprise and U.S. Treasury Department-certified Community Development Financial Institution (CDFI) dedicated to transforming consumer credit in Tennessee to be more fair, more accessible, and a pathway out of predatory lending. More at www.betterfi.co.

Have any questions or might want to partner? Please do not hesitate to reach out.

Considering a tax-deductible donation or social impact investment? Visit here or contact us.